SunCoke Energy (NYSE: SXC, $15.87) was presented at our New York idea forum on July 24. The presenter highlighted the company’s leading position in metallurgical coke production and the take-or-pay nature of its contracts with steel companies, which protects SXC from the commodity price risk. SXC was created as a tax-free spinoff from Sunoco in January 2012 and itself spun off an MLP, SunCoke Energy Partners (SXCP) in January 2013. SXC will start laying out its plans to drop down assets into the MLP in early 2014 when a two year moratorium on transactions to preserve tax-free status will expire. SXCP is currently trading well below MLP sector valuations. The presenter targets a 40% upside based on valuation arbitrage rising to 100% if the company renews a contract with ArcelorMittal for operating its Indiana Harbor facility. The contract expires in September.

A.M. Castle (NYSE: CAS, $16.16) was presented as a Buy at our July 17 San Francisco idea forum. The presenter highlighted the company’s leading position in the niche steel service center/distribution space. The new CEO hired in October 2012 is successfully leading restructuring efforts to get rid of inefficiencies from the growth through acquisition strategy of the last 10 years. EBITDA is on track to rise by $33 million from $55 million by the end of 2014, while the company is also shifting $200 million in excess inventory in the same time frame.

The presenter believes CAS is a very asymmetric risk/reward opportunity at this price. Downside is limited at this level, while upside is $27 based on a conservative 6.5x forward EBITDA multiple. Further upside to $40 is possible if the company’s end markets improve sustainably. CAS is an attractive buyout target as well, considering consolidation in the industry and the company’s strong relationships with customers.

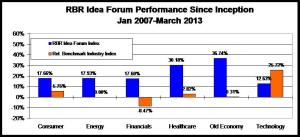

Roulston Research Idea Forum Performance

May 20, 2013

Monotype Imaging: largest font library in the world gaining from growth in CE devices/mobile

May 17, 2013

Monotype Imaging Holdings (NASDAQ: TYPE, $23.71) was recommended at our recent San Francisco idea forum. TYPE owns the largest font library in the world and gets royalty revenues every time major fonts are used, either in electronic or print formats. Fonts are increasingly crucial as tools to help companies differentiate their brands and message. The company’s major growth opportunities are centered around more screens. Sales of smartphones, tablets and other electronic devices will bring the top-line growth rate to 8-12% with the legacy printer business showing little to no growth. Content creators are increasingly turning to TYPE due to the breadth of its library and the font quality, while the use of the company’s web fonts is accelerating among web and mobile app developers. The recent announcement of a new master subscription service combining various tools in TYPE’s offering in one platform, and the launch of its cloud service are important initiatives designed to strengthen the company’s leading position in the space.

TYPE has a very profitable model with 43% operating margins and high cash flow. The company was bought from AGFA by TA Associates, a private equity firm, in 2004 and was taken public in 2007. Most of the recap debt has been paid down and once it is fully repaid, the company can be positioned for another recap or as a takeover candidate.

LIN TV (NYSE: TVL, $12.01) was recommended at our San Francisco idea forum on May 14. TVL owns 43 TV stations and 7 digital channels in 23 markets. 87% of the stations are either #1 or #2 in their local markets. The presenter argues that this is a very interesting time to be involved in the broadcasters, and LIN in particular. The factors he cites benefitting the industry include sharp growth in high-margin retransmission fees cable operators are paying for rebroadcast of network signals with strong demand for local content key to growth; growth in TV ad revenues correlated with the rebound in the economy and higher share of TV ad spending at the expense of newspapers, radio and yellow pages; growth in digital ad revenues from websites and mobile apps supported by local TV stations; and friendlier M&A environment. TVL’s peer group, despite the recent runup, as investors recognized that these companies are not going away, still trades at lower than historical multiples. TVL’s valuation in turn is significantly cheaper than most companies in the group.

The company announced in February it was exiting its NBC JV with GE Capital. To preserve NOL’s of $3/share from the taxable gain event, TVL filed with the SEC to convert ton LLC. The approval is expected to be granted in Q3, likely in September. Once the conversion is approved, the presenter expects TVL to initiate a dividend and get back into the M&A mode, or even sell the company. Sell-side coverage is limited, partly due to TVL and others in group all leveraged small caps with limited floats, but volumes have picked up lately.

Bazaarvoice Update from a Call with Management

April 17, 2013

Bazaarvoice (NASDAQ: BV, $6.81) was presented at our February idea forum in San Francisco. The company is a leading provider of ratings and review tools to online retailers and some of the world’s largest brand companies. Word of mouth, which is quickly becoming a key factor influencing both online and offline commerce, is the centerpiece of BV’s platform. The company’s organic revenue growth has slowed in the last couple quarters, but the presenter’s recent conversation with the company’s management points to significant opportunities that remain largely untapped at this point. Geographic expansion, increased penetration with brand companies and sales of ad space through the company’s media group are more immediate sources of upside. BV’s management stressed that the company’s platform is a paradigm changer for marketing departments and its relative novelty contributes to slower than desired adoption rates. Poorer than desired sales execution is another factor behind the recent slowdown, which the company is addressing.

Titan Machinery (NASDAQ:TITN, $29.03) was presented at our San Francisco idea forum on October 10, 2012. The presenter has closed his position after a 40% gain, citing hard to predict short-term trends in ag prices, the key driver for equipment sales, and the government’s decision not to renew the accelerated depreciation tax break.

Titan Machinery: Hidden Great Business

November 2, 2012

Titan Machinery (NASDAQ: TITN, $22.55) was recommended as a Buy at our recent idea forum in San Francisco. The company’s low-margin equipment sales and the balance sheet that is levered mainly because of floorplan financing hide a great business. Titan is one of the largest dealers of agriculture and construction equipment that uses equipment sales to entrench itself with customers and generate a high-margin annuity stream from parts and service. The company’s strong top-line and net income growth has been underappreciated by investors. The recent drought in the Midwest hit margins and caused a guide-down, but it’s a short term issue. Ag prices are likely approaching a trough and upside is a high probability with multiple factors driving higher prices. The management team has been first to recognize a consolidation opportunity in the industry and the company has done very well acquiring small dealerships at attractive multiples and integrating them quickly and effectively. The stock is down from $36 to $22 on short-term drought issues and lowered guidance. This is a great opportunity for investors who have a long-term view of the company’s growth runway and believe that higher ag prices are here to stay.

Rent-A-Center: 50% Upside on New Concept Growth

October 24, 2012

Los Angeles based PM recommended Rent-A-Center (NASDAQ: RCII, $32.95) as a Buy at our October 8 idea lunch in the city. The company is one of the two dominant players in the rent-to-own space. This market has seen siginificant growth as more and more consumers are unable to get financing to purchase furniture, appliances and computers. RCII has a mature store base that won’t expand beyond 1-2% annually, but its newer concept is likely to change the current perception about the company. Under the Acceptance model, RCII places kiosks at other retailers’ stores and offers customers who can’t get financing from those retailers rent-to-own options. It’s a win-win situation for everyone involved. RAC Acceptance is already present at 882 partner stores and while its contribution is not going to move the needle too much in the next 12-18 months, it will be the key growth driver over the longer term. RCII is led by a highly experienced management team focused on delivering shareholder value. The company has delevered its balance sheet following a string of acquisitions and has been buying back stock. The stock price reflects earnings from the core business, but completely disregards potential offered by RAC Acceptance. The presenter values the new concept at $14/share, targeting a 50% upside.

Sonus Networks: Large Opportunities in VoIP and Enterpise Market

October 22, 2012

Sonus Networks (NASDAQ: SONS, $1.83) was presented at our recent idea forum in Los Angeles as a Buy. The company has the industry-leading expertise in VoIP and very strong relationships with carriers, which positions it very well to gain from the telecom operators’ ongoing transition to all IP networks. The company’s recent acquisition of Netwok Equipment Technologies has greatly strengthened its SBC (session border controller) portfolio. SBCs represent an important link enabling large enterprises to consolidate their data and voice networks and get the benefits of true unified communications. Sonus has been quickly gaining share in SBCs and is well on its way to successfully implement the transition from a legacy access/trunking business to becoming an SBC-focused company. The valuation is depressed currently on weak growth and profitability historically, but the outlook will change as SBCs make a more meaningful contribution to sales. Based on peer multiples and top-line growth accelerating to 20% annually, the upside is 100%+. SONS’ business has strong operating leverage. The company’s technology and its healthy balance sheet make Sonus an attractive target for a larger competitor.